tax exempt resale certificate ohio

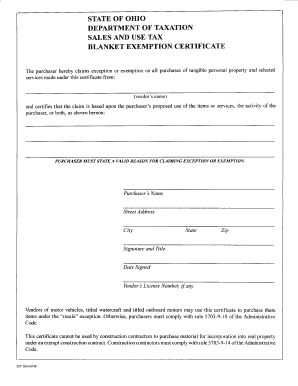

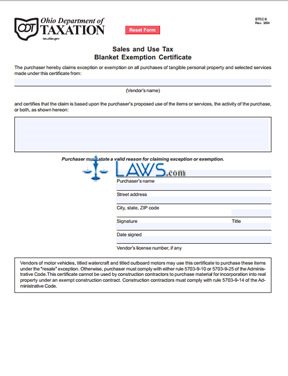

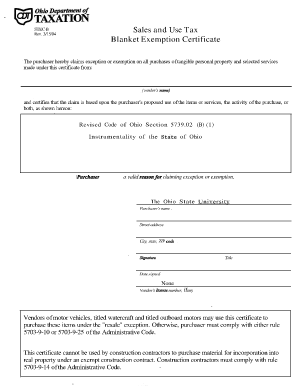

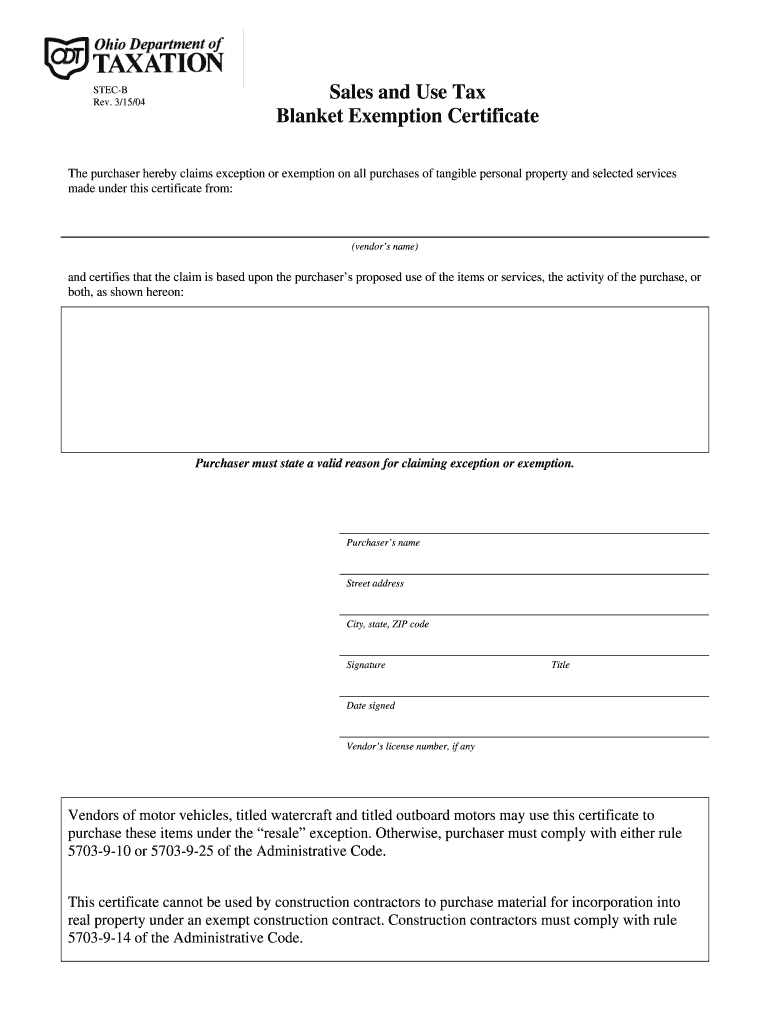

In Ohio you need to complete and present an Ohio Sales and Use Tax Blanket Exemption Certificate to the merchant from which you are buying the products to be resold. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions.

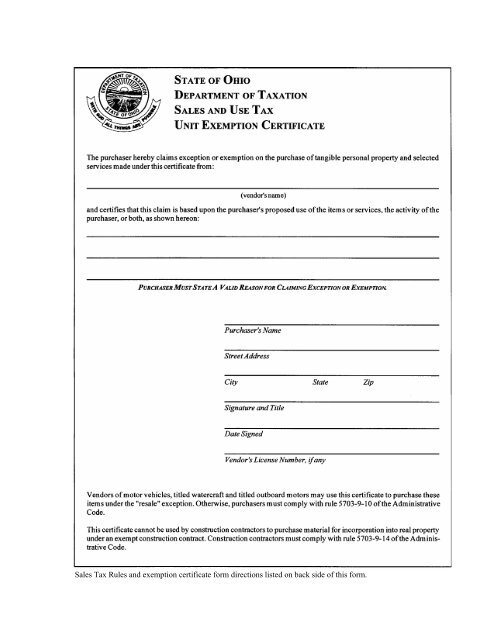

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

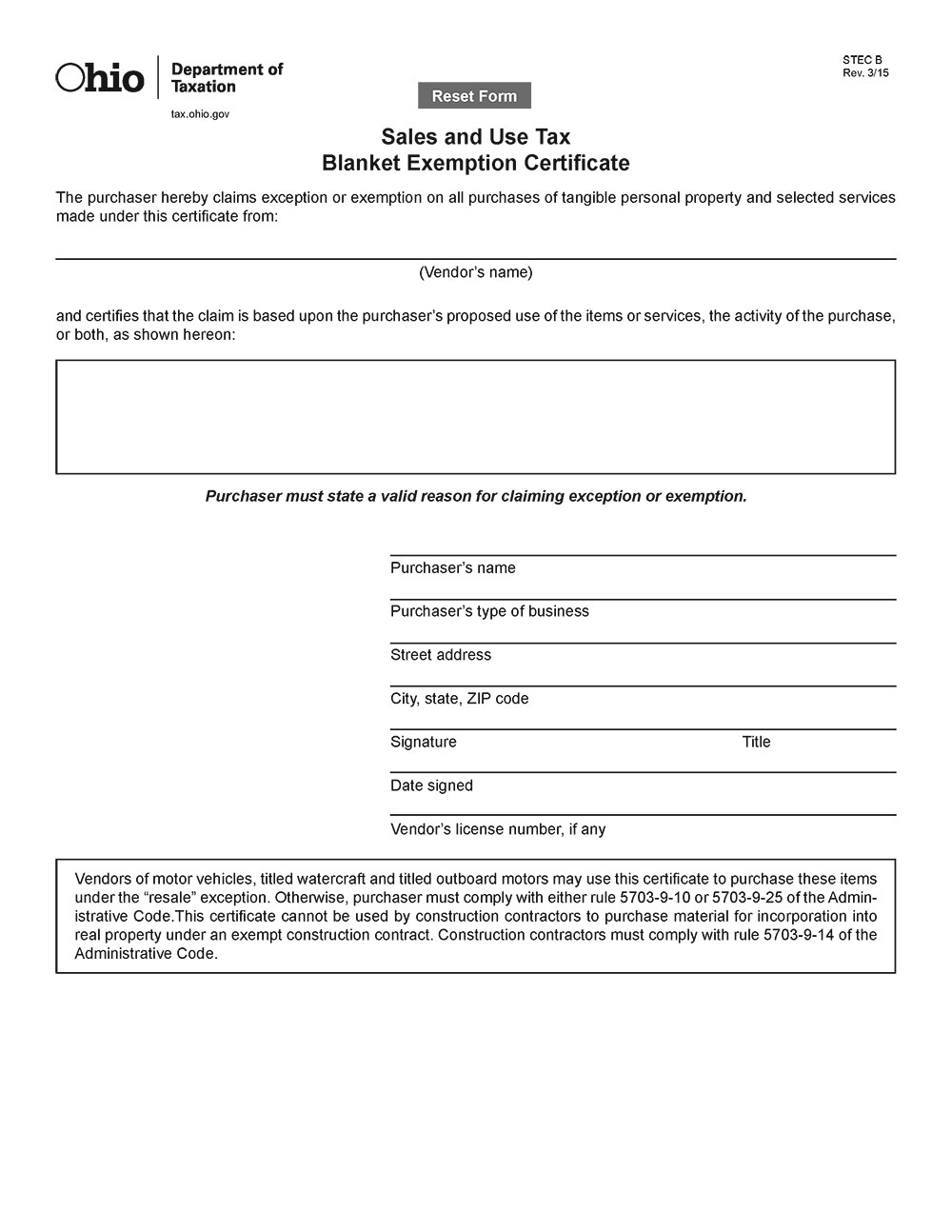

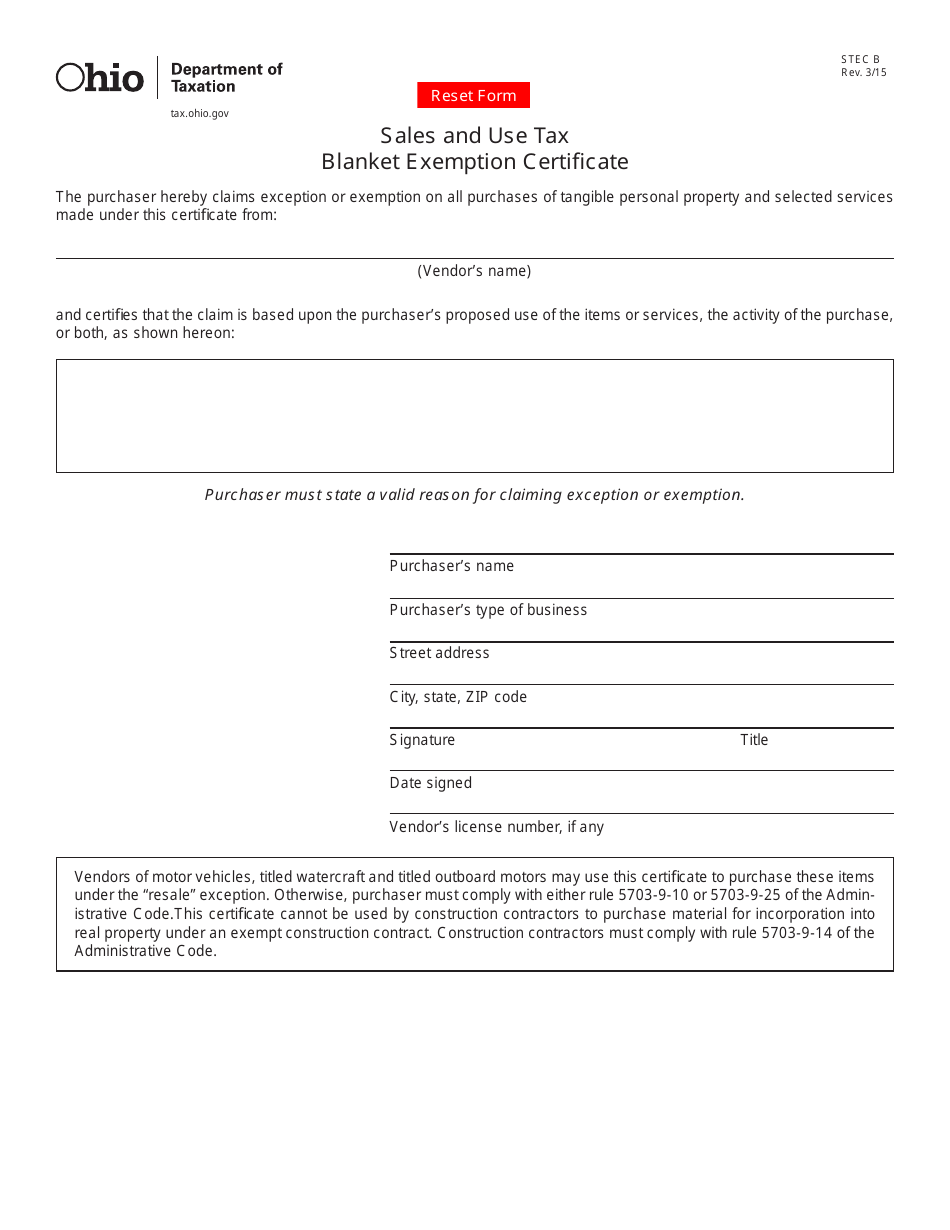

Ohio Sales and Use Tax Blanket Exemption Certificate DOWNLOAD CERTIFICATE In order to comply with the various state and local sales tax law requirements Trivantage is required to retain a properly executed exemption certificate from all of our customers who claim a salesuse tax exemption.

. A typed drawn or uploaded signature. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. A new certificate does not need to be made for each transaction.

Acceptance of uniform sales tax certificates in. A resale certificate allows businesses to buy items without paying sales tax as long as they intend to resell the items. Ohio sales and use tax blanket exemption certificate pdf.

If ones certificate does expire the purchaser should state their reason for exemption and present the certificate to the retailerseller. Vendors name and certifi or both as shown hereon. Sales and Use Tax Blanket Exemption Certificate.

Although each state has its rules with respect to whether a particular sale is exempt the Multistate Tax Commission has created a. Create your signature and click Ok. Learn more about what a resale certificate is how to get one and more.

A - is registered as a New York State sales tax vendor and has a valid Certificate of Authority issued by the Tax Department and is making purchases of tangible personal property other than motor fuel or More. Decide on what kind of signature to create. Blanket Resale Certificate In Ohio the use of blanket certificates are permitted for use.

There are three variants. Ohio does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re-used for all exempt purchases made from that vendor. State Of Resale Certificate Simple Online Application.

In Ohio the Ohio sales tax exemption certificate has no hard or set date of expiration. 2 Get a resale certificate fast. A tax-exempt resale certificate that a business holds only allows it to withhold sales tax on eligible goods and services.

To claim the ohio sales tax exemption for manufacturing qualifying manufacturers need to complete ohio sales tax exemption form stec b which is a sales and use tax blanket exemption certificate and provide a copy of this certificate to their vendorsin addition to requiring purchaser information such as name address and business type ohio. Purchaser must state a valid reason for claiming exception or exemption. 2 Exemption certificate forms are available on the departments website at taxohiogov.

Requirements for a Tax-Exempt Resale Certificate. Ad State Of Resale Certificate Wholesale License Reseller Permit Businesses Registration. I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that I know at the time of purchase are purchased for use rather than for the purpose of resale lease or rental and depending on the amount of tax evaded the offens e may range from a Class C misdemeanor to a felony of the second degree.

This short guide will give you what you need to know to buy products for resale in Ohio and what to do if youre presented with an Ohio resale exemption certificate. Follow the step-by-step instructions below to design your tax-exempt form Ohio. The state of Ohio sales tax and use tax rate currently is at 575.

If you are a business owner in Ohio you may want to get a Sales Tax Exemption Certificate in order to purchase goods for resale without paying sales tax. I hereby certify under the penalties of perjury that the property purchased by the use of this exemption certificate is to be used for an exempt purpose pursuant to the State Gross Retail Sales Tax Act Indiana Code 6-25 and the item purchased. The lowest tax including county and state taxes within the state is 650 and the highest is 800.

Ohio Resale Certificate General Description Taxable items intended for resale are not subject to sales tax in Ohio. Read through the instructions to learn which information you have to provide. Select the document you want to sign and click Upload.

March 4 2011. This certificate is only for use by a purchaser who. Select the fillable fields and put the necessary information.

Stick to these simple steps to get Ohio Resale Certificate completely ready for sending. The vendor must retain the fully completed exemption certificate in its files. Additional sales and use tax can be further levied by the counties and regional transit authorities.

Form ST-120 Resale Certificate is a sales tax exemption certificate. If you are running an auto spare part shop for instance the inventory acquired from the wholesaler is exempt from tax. The exemption certificate may be provided electronically or in hard copy.

All businesses engaging in interstate commerce should be familiar with the Multistate Exemption Certificate which can be used to support the resale exemption from sales and use tax in a substantial majority of states. This is because you plan to sell your merchandise to your customers and amass tax from the sales. Open the template in the online editing tool.

Ad 1 Fill out a simple application. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now. Find the form you want in our collection of legal templates.

Most state sales tax exemption certificates do not expire and the seller is required to maintain exemption certificates for as long as sales continue to be made to the purchaser and sales tax. However when such a business with a tax-exempt resale certificate purchases goods or services for the purpose of its use then sales tax must be paid on such items. If you Wish to Use an Ohio.

Ohio Tax Exempt Form For Farmers Fill Online Printable Fillable Blank Pdffiller

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

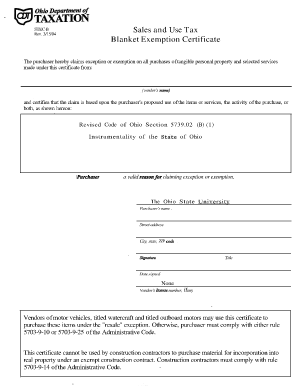

Blanket Certificate Of Exemption Ohio Fill Online Printable Fillable Blank Pdffiller

Free Form Sales And Use Tax Blanket Exemption Certificate Free Legal Forms Laws Com

Links To All State S Resale Certificates

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Ohio Sales Tax Exemption Form Blanket Iae News Site

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Resale Certificate 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Printable Ohio Sales Tax Exemption Certificates

Form Stec U Fillable Sales And Use Tax Unit Exemption Certificate

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller